Project Description

King IV: it will make your Board ‘rock’!

Boards of Directors of large companies are featuring more and more in the daily news and in business conversations. The reason is that society wants to understand how it is they cannot hold their company managers accountable for major financial mistakes, or fraud, or catastrophic lack of risk management, leading to the destruction of a brand’s value, or the reputation of a corporation or industry. Boards of Directors are also responsible for approving the multi-million bonuses paid to executives whose performance is questionable, in times when companies are struggling to survive and economies are stagnant.

In addition, mainstream investment firms, such as State Street, BlackRock and Vanguard, are calling for greater transparency along with the Council of Institutional Investors which says that disclosure about performance assessment “is an indication that a board is willing to think critically about its own performance on a regular basis and tackle any weaknesses … and can be a catalyst for ‘refreshing’ the board as new needs arise.” [1]

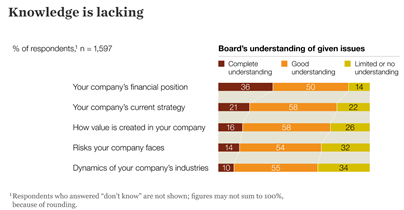

Experts and large consulting firms have tried to investigate why boards are not performing as they should[2]. The reasons, they say, are related to the often unclear definition of the board’s role, but, more importantly, the problem may be a lack of skills to deal with risks and a lack of understanding of value creation, as Fig. 1 below and the references show.

Fig. 1. Knowledge is lacking

Source: http://www.mckinsey.com/global-themes/leadership/governance-since-the-economic-crisis-mckinsey-global-survey-results

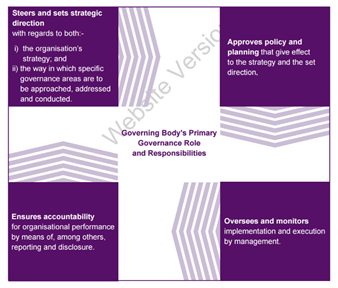

But there is good news: after the launch of the King IV Report (and Code) there are no more excuses for not getting the Board of your organization on the right track! King IV is a forward-looking guide for Boards of Directors on their role (see Fig. 2) and their practices.

Fig 2. The Board’s role

Source: King IV, pg 25.

Sixteen principles should guide a Board’s practice. Among them it is worth highlighting:

Principle 2: The governance body should govern the ethics of the organisation in a way that supports the establishment of an ethical culture.

Principle 4: The governance body should appreciate that the organisation’s core purpose, its risks and opportunities, strategy, business model, performance and sustainable development are all inseparable elements of the value creation process.

Principle 14: The governance body should ensure that the organisation remunerates fairly, responsibly and transparently so as to promote the achievement of strategic objectives and positive outcomes in the short, medium and long term.

But the Code is much more than a tool to get Boards on the right track in terms of their responsibilities in response to society’s expectations. In the words of Professor Mervyn E King SC, the Chairman of the King Committee: “There is a global shift to inclusive capitalism and value creation in a sustainable manner as opposed to the plague of short-term profit at a cost to society and the environment. Governance bodies have to be prepared for that.”

In partnership with experts, Arbex & Company is ready to help your Board get to know the King IV Code and prepare for the future. To find out more, get in touch with us.

[1] https://www.spencerstuart.com/research-and-insight/performance-in-the-spotlight

[2] http://www.pwc.com/us/en/corporate-governance/annual-corporate-directors-survey/board-composition-and-diversity.html; http://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/improving-board-governance-mckinsey-global-survey-results ; https://home.kpmg.com/content/dam/kpmg/xx/pdf/2016/09/aci-global-pulse-survey-building-a-great-board-door.pdf.

ps:The 17th principle applies to pension funds and other similar organizations.

text by Nelmara Arbex